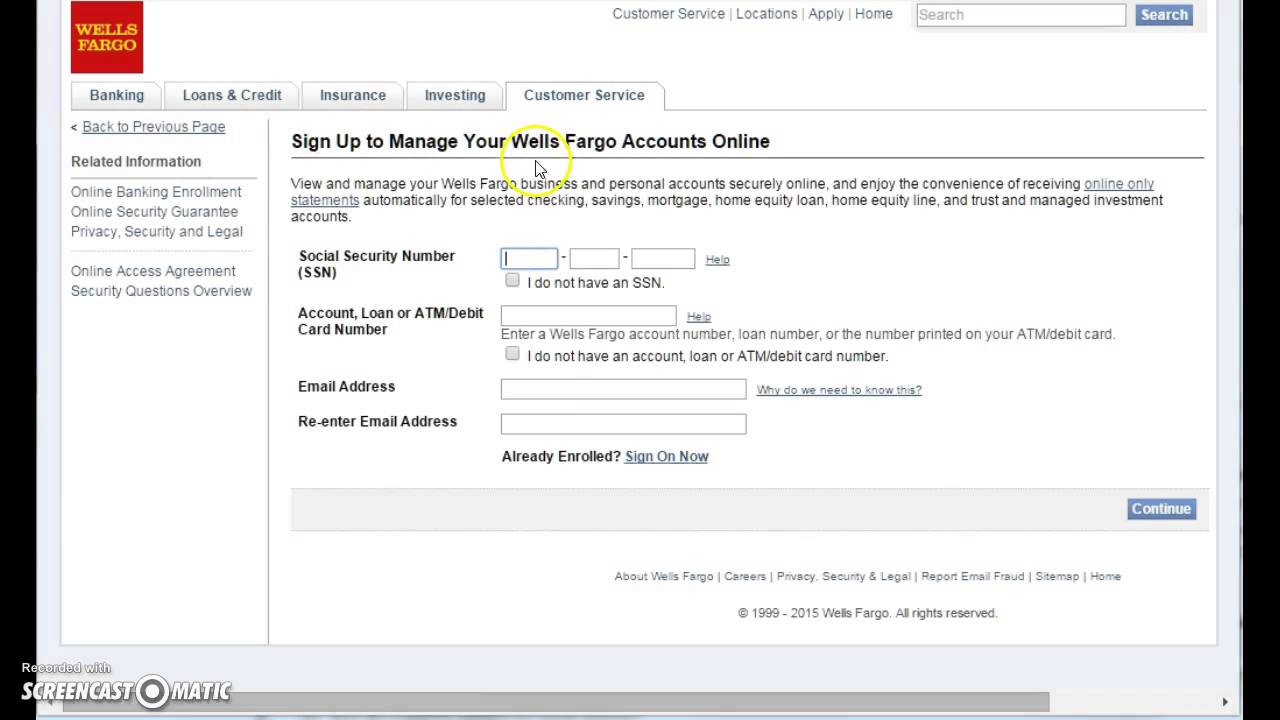

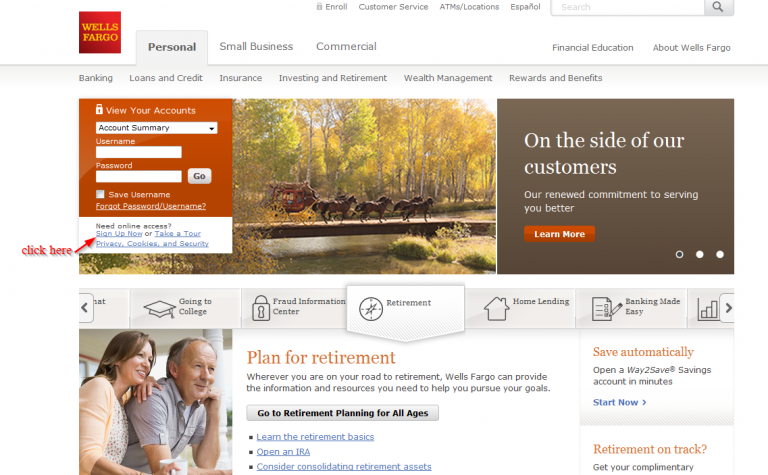

Canada Users Sign On Here Utilisateurs Canadiens Veuillez ouvrir une session ici. The payee may charge additional fees when the check is returned. We previously sent you an email providing details on what next steps you need to take before you are able to log in to your account. Please refer to our fees page for fees associated with our online services. With online banking through Wells Fargo Online you can monitor your balances and activity set up alerts and view statements all from your smartphone tablet or desktop.

Make sure that any outstanding checks have been paid andor you have made different. Click HERE to pay your Wells Fargo Financial credit card accounts ONLINE. Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust.

Neither Wells Fargo nor Zelle® offers a protection program for authorized payments made with Zelle®. The Request feature within Zelle® is only available through Wells Fargo using a smartphone. In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®.

To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution's online or mobile banking experience. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement. Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle®. Available to almost anyone with a U.S.-based bank account.

The Request feature within Zelle® is only available through Wells Fargo using a smartphone, and may not be available for use with all small business accounts at this time. To send money to or receive money from an eligible small business, a consumer must be enrolled with Zelle® through their financial institution. Small businesses are not able to enroll in the Zelle® app, and cannot receive payments from consumers enrolled in the Zelle® app. For more information, view the Zelle® Transfer Service Addendum to Wells Fargo's Online Access Agreement. Wells Fargo is a US-based multinational financial services company that offers people a number of options to handle their financial needs, including checking and savings accounts, credit cards, investments and loans.

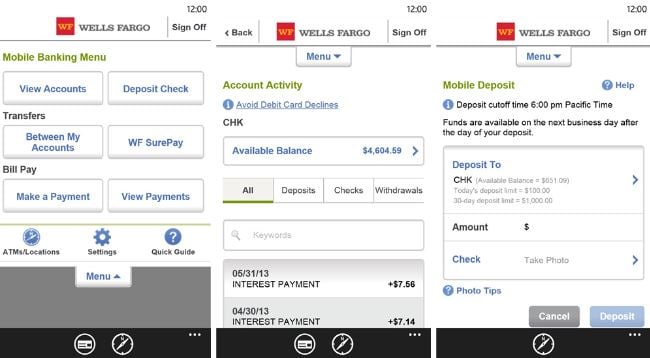

The company also has a dedicated mobile app for customers to enable quick access to accounts, view and conduct transactions, among a host of other features. The Wells Fargo Mobile App is very Convenient & Easy to Use!!! I like being able to check my account balance at anytime and anywhere I go. I also like being able to send money through "Zelle" into my mother's account without the added hassle of going to the bank and withdrawing the cash to pay my portion of monthly bills.

My only dislike of the Mobile App is the fact that sometimes the available balance shown on the account is not always accurate. Due to the fact of ATM fee charges on withdrawals being taken sometime after the transaction instead of when the transaction is posted & done. I have had to keep an extra written balance on my account to make sure that I don't overdraft my account and even then I have had to go back and deposit money to keep my account balanced. I get alerts for any activity is done on my account and when my account reaches or drops below zero balance enabling me to be aware of any fraudulent use of my account or overdrafts.

Overall I think it's a great way to keep track of my banking!!! Turning off your card is not a replacement for reporting your card lost or stolen. Contact us immediately if you believe that unauthorized transactions have been made. Turning your card off will not stop card transactions presented as recurring transactions or the posting of refunds, reversals, or credit adjustments to your account. Any digital card numbers linked to the card will also be turned off. For debit cards, turning off your card will not stop transactions using other cards linked to your deposit account.

For credit cards, turning off your card will turn off all cards associated with your credit card account. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's messaging and data rates may apply. Wells Fargo Everyday Checking is Wells Fargo's most popular account for day-to-day banking.

The other Wells Fargo savings account is Platinum Savings. This account carries a $12 monthly service fee, which is waived by maintaining a $3,500 minimum daily balance each statement period. Platinum Savings account holders can receive a complimentary debit card, a perk that isn't common with savings accounts.

The Chase app allows you to pay bills, transfer money to friends via Zelle, and schedule payments for your credit card, mortgage or other loans. You can also see your TransUnion credit score in the app. And if you have one of Chase's popular rewards credit cards, you can also view and redeem your Ultimate Rewards through the app.

Once upon a time, features like mobile check deposit were considered cutting edge. Now, consumers have come to expect that kind of functionality, along with seamless money transfers, bill pay, ATM locators and more. Today, some apps will even let you track accounts from different financial institutions.

Others offer built-in financial wellness and budgeting platforms. If mobile offerings are a deciding factor for you in choosing a bank, we've assembled this list of the 10 best banking apps in 2021. Monthly service overdraft may also apply to your account s that you make Bill Pay payments from.

Bank online Find routing or account number Products and services. Charges may apply however for the Wells Fargo Same Day Payments Service SM. But draw back is it is very easy to deposit the check to the wrong account since I have one business account and one personal account. Today I log in to my accounts and click on the Business Account, then press the check deposit, After I finished the deposit the screen went back to personal account then I realized the check went to the wrong account. Tomorrow I will need to go to ATM or bank to do the deposit, that defeats the purpose of mobile deposits.

The other drawback is the monthly limit for mobile check deposit too low. I have have paychecks once every two weeks, I have to deposit my second check to my other bank account due to the limit. The withdraw and deposit amount not quite easily distinguishable. I wish the withdrawals can have negative sign at the front just like the deposit with positive sign.

Wells Fargo has implemented different tactics within their mobile strategy to address customer's security concerns. Customers are provided with instructional videos to show mobile banking benefits, and the inclusion of mobile banking within their overall security guarantee. Wells Fargo also provides a link on its native app login screen explaining the mobile and online security policy.Additionally, Wells Fargo announced plans to roll out a new eye-scan for mobile app sign in by July 2016. This biometric functionality will only be available to their commercial lending customers—those who handle millions of dollars worth of transactions.

While the larger portion of their customers are missing out—for now—it's these kinds of offerings that show the headway Wells Fargo is making in terms of mobile banking. Traditional banks need to take a page out of the Wells Fargo playbook and ensure they have a solid digital strategy in place and are focused on providing new ways to meet increasing customer needs. Enrollment in Wells Fargo Online® Wires is required, and terms and conditions apply. Applicable outgoing or incoming wire transfer service fees apply, unless waived by the terms of your account.

Wells Fargo Online Wires are unavailable through a tablet device using the Wells Fargo Mobile® app. To send a wire, sign on at wellsfargo.com via your tablet or desktop computer, or sign on to the Wells Fargo Mobile app using your smartphone. For more information, view the Wells Fargo Wire Transfers Terms and Conditions. Bank customers can get to the new money transfer tool through their bank's mobile app. To send money, you only need to enter the phone number or email address of the person you'd like to send money — though that person has to have signed with their bank to receive money.

To do that, customers have to tell the bank which email address or phone number they'd like friends to send money to, and the account they'd like that money to go to — checking or savings, for instance. Having multiple recurring payments and connection points online creates a greater need for consumers to have visibility into and control over where and what account information is shared. By bringing these capabilities into one place, Control Tower is helping to relieve this customer pain point. Among Americans who use a bank or financial institution, three quarters report that having a single view of their digital financial footprint – such as the Control Tower offering2 – would be beneficial1. Unlike most major bank apps, the Chase app allows you to reload your Chase Liquid debit card.

In fact, it offers access to most of your accounts including checking, savings, and credit card options as well as investments. If you don't like to carry your card around or often forget to bring it with you, the PNC mobile banking app may be right for you. While some banking apps let you use your phone as your debit card, PNC Bank extends access to your credit and SmartAcess Cards. With this app, you'll never have to worry about not being able to make a purchase because you misplaced or lost your card.

Simplify your life and stay in control with the Wells Fargo Mobile® App. Manage your finances; make check deposits, add cards to digital wallet, transfer funds, and pay bills, all within the app. • Quickly access your cash, credit, and investment accounts with Fingerprint Sign On¹ or Biometric Sign on¹.

There isn't a one-size-fits-all approach to banking needs. Wells Fargo has understood, early-on, the value behind differentiating mobile content and messages from content more appropriate for other channels like desktop, branch, and ATM. By defining accurate customer profiles and developing mobile personas based on the current and future customers, banks may execute a mobile strategy for a broader customer base. It is clear that users of all sophistication level will demand form and function before using a tool—a clear, intuitive interface, and functions/features that match their different values and key banking needs. By creating personas for customers, Wells Fargo helps to drive better user experiences that fit the needs the customers.

This also provides insight into where they have pain points and require additional support from mobile services. Wells Fargo also touts the use of your Way2Save account as a method of overdraft protection for customers who also have checking accounts. If you sign up for this optional service, Wells Fargo will transfer money from your Way2Save account into your checking account to cover an overdraft.

However, this service doesn't prevent you from being charged a $12.50 overdraft fee once per business day. The fee can be avoided if a covering transfer or deposit is made on the same business day. Mobile deposit is only available through the Wells Fargo Mobile® app. See Wells Fargo's Online Access Agreement for other terms, conditions, and limitations.

Control Tower represents the latest iteration of Wells Fargo's continually evolving mobile experience. In the future, customers also will be able to control which devices, apps, and companies have access to their account information. Once you click on your credit card account from within the app, you can pay your card from a connected bank account with a few taps. You can also review upcoming due dates, minimum payments due and available credit.

From the app, you can add cards to your digital wallets, including Apple Pay and PayPal. Certain devices are eligible to enable fingerprint sign-on. If you store multiple fingerprints on your device, including those of additional persons, those persons will also be able to access your Wells Fargo Mobile® app via fingerprint when fingerprint is enabled. Your mobile carrier's messaging and data rates may apply. Only select Apple devices are eligible to enable Face ID®. If you have family members who look like you, we recommend using your username and password instead of Face ID® to sign on.

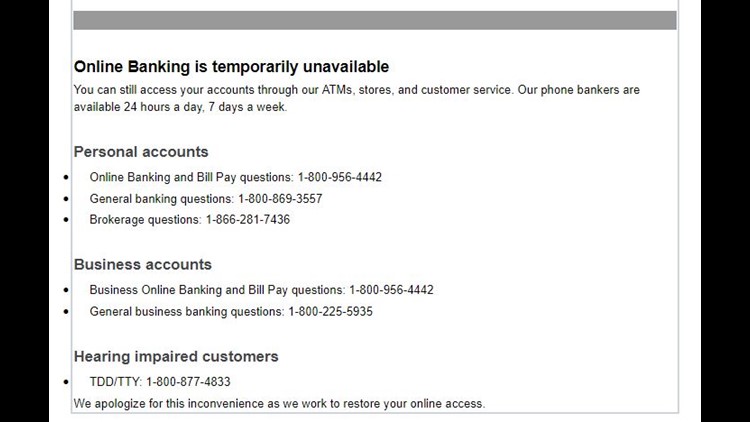

The account comes with access to Wells Fargo Mobile app, a debit card with chip technology, budgeting, cash flow and spending tools, online bill pay and 24/7 customer service. Account holders also have access to the Zelle peer-to-peer payment platform. Wells Fargo customers trying Wednesday to find out if their stimulus payments had arrived instead found their mobile app not working and online accounts not accessible. The bank said the outage is due to high volumes and won't affect the electronic deposit of the stimulus money. The world of mobile banking is an ever-expanding one, and you can bet that consumer demand will drive its future.

You can also count on tech-focused banks to invest heavily in improving their products. But with so many options out there, you have to ask yourself what you really want out of a banking app. Do you like access to multiple accounts and being able to turn your phone into a digital wallet?

What about being able to trade stocks and make other investments? Whatever feature you find most appealing, there's an app for you. I was recently charged over $375 in Overdraws, I HAD overdraw protection and it seems that the ability of the app to CURRENTLY reflect balance is off. I made one purchase knowing I would be charged and had no problem paying the $35 fee, but when my bank then had a positive balance and I made 10 small purchases and unfortunately had to overdraw again. I was beyond surprised to see that not only was I charged for the transaction in which I knew I would have to pay, I was charged for the previous 9 also, so I was left with a total of $385 in fees. I'm now 2 weeks late on rent and have to wait until my next pay check and pay late fees to my landlord and cell phone.

You guys wouldn't waive not one fee, the basis being that when my account was hacked I was refunded $210. So apparently you guys only cover your own tail and could care less about someone who has been with you since the age of 18. I hope someone sees this and realizes the real and true ripple effects caused by your guys' predatory practices.