² Chime SpotMe is an optional, no fee service that requires a single deposit of $200 or more in qualifying direct deposits to the Chime Spending Account each month. Your limit will be displayed to you within the Chime mobile app. You will receive notice of any changes to your limit. Your limit may change at any time, at Chime's discretion.

Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe won't cover non-debit card transactions, including ACH transfers, Pay Friends transfers, or Chime Checkbook transactions. Another option is Fifth Third Bank's Express Banking account, which allows account holders to immediately access their check deposits for a fee, which varies by the frequency of customer activity. The fees range from free for Fifth Third checks for high-transaction customers to 4% on personal checks for low-transaction customers. The Express Banking account, which comes with an optional debit card, has no minimum balance requirements and charges no monthly service fee and no overdraft fees.

A key part of Wells Fargo's business strategy is cross-selling, the practice of encouraging existing customers to buy additional banking services. Customers inquiring about their checking account balance may be pitched mortgage deals and mortgage holders may be pitched credit card offers in an attempt to increase the customer's profitability to the bank. Other banks have attempted to emulate Wells Fargo's cross-selling practices . A bank overdraft means that you spend more money than the one you have left in your bank account. I haven't been hit with any hidden fees and I got a couple of overdraft fees waived by them.

Granted I use the Wells Fargo banks that used to be Wachovia which was always known for its customer service. Banks and credit unions often will cash government, payroll, and other official checks along with personal checks if the check-writer has an account at the same institution. The check-issuing bank's logo typically is printed on the check.

Some—but not all—major banks will cash checks for non-account holders, usually for a fee, as long as the checking account has sufficient funds. In some cases, the bank may waive check-cashing fees if you open a bank account. If you don't need actual cash, but just access to some of your check's funds quickly, consider transferring the check's funds to a prepaid debit card. Depending on the card, you'll likely be charged a fee for opening a new prepaid card and each time you deposit a check.

How quickly you can access all or part of the funds from the prepaid card depends on the funds availability policy for the card. Payroll and government benefits checks can be directly deposited onto a prepaid card, with the funds available immediately. Some cards use a third-party service that allow you to load a check onto your prepaid card within minutes by snapping a picture of your check, usually for a fee. Melio's bill paying platform is designed to help small businesses pay their bills in ways that free up schedules and extend cash-flow. You can pay your vendors using a bank transfer or credit card - even if cards aren't accepted. That's because Melio transfers the payment to your vendor's bank account or mails them a check on your behalf.

Digital wallet access is available at Wells Fargo ATMs displaying the contactless symbol for Wells Fargo Debit andWells Fargo EasyPay® Cards in Wells Fargo-supported digital wallets. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply. Some ATMs within secure locations may require a card for entry. A bank account sort code is a number utilized by banks located in the UK to determine which banking institution the account is handled by.

Though you could go into your local branch and ask the teller to print out a statement that explains how you can find your sort code, it is much less complicated to easily find it on your debit card. 4Touch ID is available only for newer iPhone models using iOS 8 or higher. Face ID is available only iPhone models X and later. Use of your Mobile device requires enrollment in Online Banking and download of our Mobile App. Wireless carriers may charge fees for text transmissions or data usage. Mobile Banking requires an internet-ready phone and is supported on Apple iPhone devices with iOS 9 and greater and on Android mobile devices with OS 5 and greater.

Mobile deposits made before 7 pm PT will be processed the same business day and made available within two business days. Longer delays may apply based on the type of items deposited, amount of the deposit, account history or if you have recently opened your account with us. All banks set aside significant amounts of capital early on in the pandemic to prepare for what they thought could be tens of billions in loan losses. At the time, those loan-loss provisions cut into bank earnings. Many banks likely would have experienced big losses in the first half of 2020 had it not been for the high volatility in the market, which set up a massive year for investment banking. Yes, Melio supports a multi-track payment method so you can pay whichever way you want and have your vendors receive payment by bank deposit or paper check.

That means you can pay all your vendors by bank transfer or credit card - regardless of how they're set up to receive payments. Wells Fargo's biggest regulatory issues stem from its phony accounts scandal, in which thousands of employees at the bank opened millions of depository and credit card accounts for customers without those customers' approval or knowledge. It was one of the biggest scandals in banking history, but it had little to do with the institution's investment banking or non-bank activities. It had everything to do with Wells Fargo's high-pressure sales culture and its lending practices. However, using traditional banks to send money abroad can be slow and expensive.

Try Wise for fast, cheap and secure international money transfers. Digital wallet access is available at Wells Fargo ATMs for Wells Fargo Debit Cards and Wells Fargo EasyPay® Cards in Wells Fargo-supported digital wallets. Some ATMs within secure locations may require a physical card for entry.

ATM Access Codes are available for use at all Wells Fargo ATMs for Wells Fargo Debit and ATM Cards, andWells Fargo EasyPay® Cards using theWells Fargo Mobile® app. Topics in this section include PayPal, bank accounts, credit cards, Socks etc. Paid forum accounts required to access these topics. Carding tutorials, carding tools, proofs, list of cardable websites etc. are some of the free content. This scam dates back to 2005, when retailers sued Wells Fargo and credit card companies for setting high swipe fees on certain cards.

By favoring some cards over another, the banks basically forced merchants to penalize customers. After dozens of lawsuits flooded in, the credit card companies and big banks paid out well over $6 billion back to merchants for the charges. Your account balance will transfer to Principal based on the account value at market close.

Please note, this does not impact non-retirement account you have with Wells Fargo. You can continue to access those throughwellsfargo.comor through the Wells Fargo mobile app. Simply insert your debit card and input your Personal Identification Number to withdraw cash, make deposits and check your account balance. Of the four U.S. megabanks, Wells Fargo has the smallest investment banking operation, although it is seeking to expand that unit. It also left the Great Recession with the smallest loan losses of the four, and has consistently had good credit quality. In addition, Wells Fargo's structure has gotten a lot simpler in recent months.

It announced several sales in asset management, its equipment financing business in Canada, its student lending portfolio, and its corporate trust services business. These divestments were made after management determined that the best strategy for the institution would be to focus on its core U.S. franchise. In September 2016, Wells Fargo was issued a combined total of $185 million in fines for opening over 1.5 million checking and savings accounts and 500,000 credit cards on behalf of customers without their consent.

The scandal was caused by an incentive-compensation program for employees to create new accounts. It led to the firing of nearly 5,300 employees and $5 million being set aside for customer refunds on fees for accounts the customers never wanted. Carrie Tolstedt, who headed the department, retired in July 2016 and received $124.6 million in stock, options, and restricted Wells Fargo shares as a retirement package. The cost of enabling credit card payments is much more expensive for Melio than using bank transfers. The 2.9% processing fee is used to cover the costs of processing credit cards. Melio doesn't charge a monthly fee, but only per transaction, and only for credit cards.

When paying by credit card, a 2.9% processing fee applies to the payment sender. The IBAN is your account number for all money transfers. The International Bank Account Number has been introduced to standardize the identification of bank accounts across all banks.

With IBAN, every customer now has an international account number, helping to reduce transfer errors. Fortunately, many issues raised here can be readily resolved. Issues like agent interaction and self-serve technology can streamline bank account and credit card onboarding experiences for Millennials, Gen Z, and other generations of customers. Most consumers with a bank account can cash any check at their own bank for free. But if you're one of the millions of Americans with no bank account, you'll probably have to cash your check at a big-box store, supermarket, bank or check-cashing center. You typically pay a fee ranging from $3 to a percentage of the check amount and will be required to present a valid ID.

Wells Fargo recently paid fines totaling $185 million for the creation of 2 million unauthorized accounts since 2011. But the international banking and financial institution could be committing this fraud since as early as 2005, according to a letter obtained by Vice News. Wells Fargo Asset Management is a trade name used by the asset management businesses of Wells Fargo & Company. Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Managed Account Services and Wells Fargo Funds. Elizabeth Magner, a federal bankruptcy judge in the Eastern District of Louisiana, cited the bank's behavior as "highly reprehensible", stating that Wells Fargo has taken advantage of borrowers who rely on the bank's accurate calculations. The firm's primary subsidiary is Wells Fargo Bank, N.A., a national bank chartered in Wilmington, Delaware which designates its main office in Sioux Falls, South Dakota.

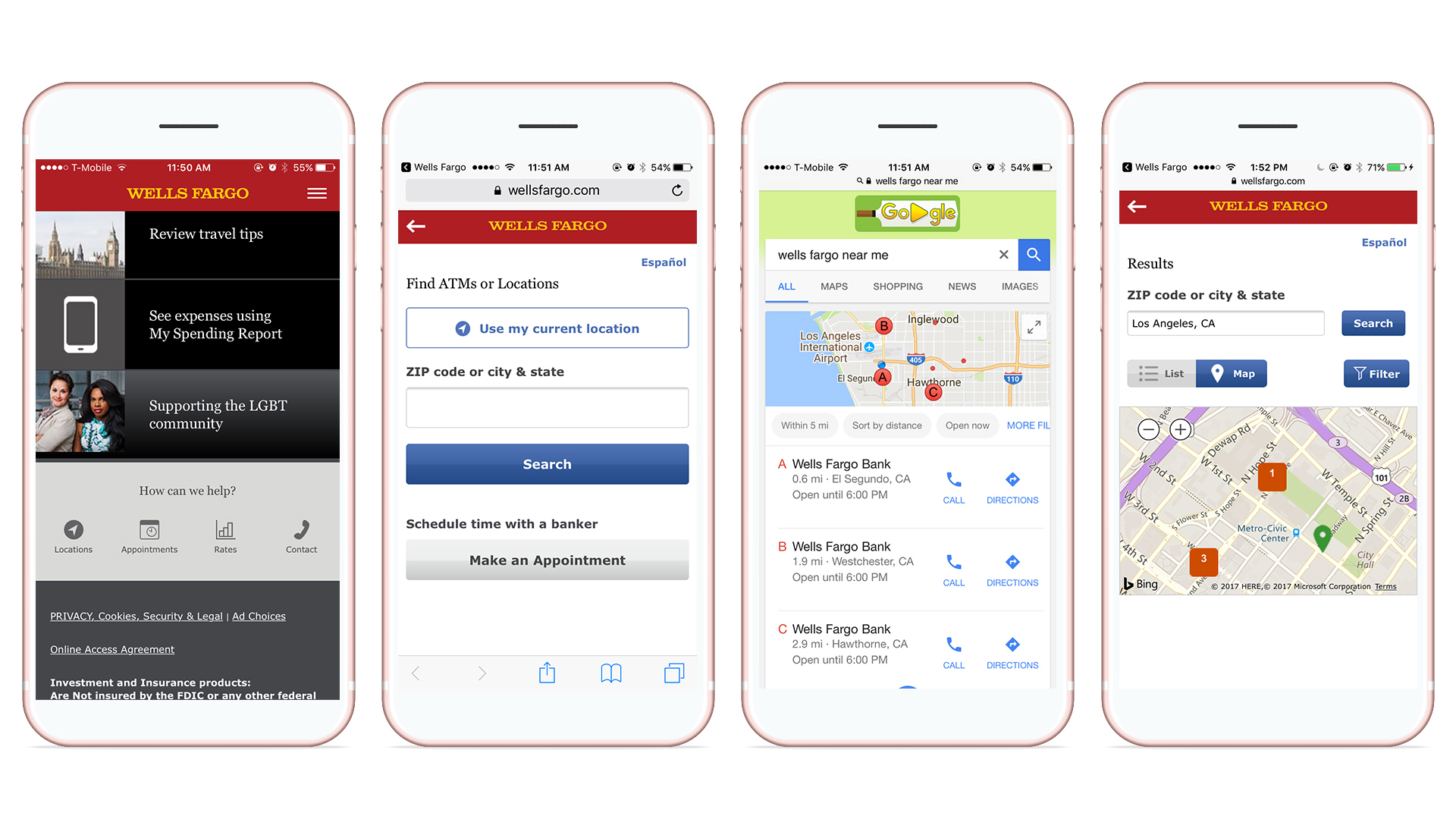

It is the fourth largest bank in the United States by total assets and is one of the largest as ranked by bank deposits and market capitalization. Along with JPMorgan Chase, Bank of America, and Citigroup, Wells Fargo is one of the "Big Four Banks" of the United States. Are you looking for the nearest Wells Fargo bank around you? Information about the closest Wells Fargo branches and locations can be found below, as well as the phone number of the customer service department, info about the business hours and more relevant details. Your available balance may not reflect all of your transactions, such as checks you have written or debit card transactions that have been approved, but not yet submitted for payment by the merchant.

Why do you keep paying Wells Fargo fees every month? Chime account is a modern alternative to traditional banks. No fees, easy money management, and an award-winning mobile app. Then there are the 650 digital products which host products such as porn accounts, hacked credit cards, bank details and everything else which can be delivered to you digitally without the need to ship products physically.

Fraud claims the third position with products such as hacked bank accounts, CVV dumps etc. While banking can't be simplified to a single tweet or post, we can create an improved digital banking customer experience. We should make it our goal to make banking experiences straightforward – even for the person who is more accustomed to checking their Instagram account than their bank account. We are gonna show you our step-by-step journey of opening a new bank account and applying for credit cards and loans at several banks. As a long-time financial services executive, Van Beurden noted that banks are slow, with the behemoths like Wells Fargo often taking more than a year to deliver programs. He has driven his team to halve or even to cut the time to a third of that.

He painted the picture of the typical way of doing things, and then offered the improvement. He highlighted the typical process with many handoffs along the way. "You already near 60 weeks' worth of work right there." The improvement comes through multifunctional teams that do not require inefficient handoffs. "The analyst with the product idea sits down with the engineer who is supposed to build a feature, who is also the one who can directly put it in production because he or she is using DevOps tools like we have today.

You take away that whole notion of handoff, handoff, handoff." Next, he noted that process automation is critical. He highlighted that speed is the key differentiator to maximize revenues and to gain advantage over the rest of the market through better return on investment. Bank online through Chime and get fee-free cash withdrawals with your debit card at 60,000+ fee-free ATMs¹, plus many more cash-back locations at retailers such as Walmart, Dollar General, and more. You can also locate fee-free ATMs using the ATM Finder in the Chime app. Chime is a financial technology company, not a bank. Banking services provided by, and debit card issued by, The Bancorp Bank or Stride Bank, N.A.; Members FDIC.

With CEO John Stumpf paid 473 times more than the median employee, Wells Fargo ranked number 33 among the S&P 500 companies for CEO—employee pay inequality. After being contacted by the media, Wells Fargo responded that all employees receive "market competitive" pay and benefits significantly above US federal minimums. From December 2012 through February 2018, Wells Fargo reportedly helped two of the biggest firearms and ammunition companies obtain $431.1 million in loans.

It also handled banking for the National Rifle Association and provided bank accounts and a $28-million line of credit. In 2020, the company said that it is winding down its business with the National Rifle Association. On October 12, 2016, John Stumpf, the then chairman and CEO, announced that he would be retiring amidst the scandals. President and Chief Operating Officer Timothy J. Sloan succeeded Stumpf, effective immediately.

Following the scandal, applications for credit cards and checking accounts at the bank plummeted. In response to the event, the Better Business Bureau dropped accreditation of the bank. Several states and cities ended business relations with the company.

Local time (8 p.m. in Alaska) are considered received on the same day. Local time (8 p.m. in Alaska), on a bank holiday or weekend, the check deposit will be considered received the next business day. Use theWells Fargo Mobile® app to request an ATM Access Code to access your accounts without your debit card at any Wells Fargo ATM. Apply for a bank account online with Santander Bank.

Enjoy convenient online bank account options from one of the best personal banks. Manage your banking online or via your mobile device at wellsfargo.com. With Wells Fargo Online® Banking, access your checking, savings and other accounts, pay bills online, monitor spending & more. The following national stores and major grocery stores will cash payroll checks along with government-issued checks like Social Security checks and tax refund checks. They'll usually also accept cashier's checks, insurance settlement checks and retirement plan disbursement checks.

Kmart and Publix are the only retailers listed below that accept personal checks. Some regional or local grocery stores not listed below may also cash checks. Visit the customer service counter of your local supermarket to find out if they cash checks and what types they accept. You can also withdraw cash using SpotMe—Chime's fee-free overdraft feature that lets you overdraft up to $2002 with your debit card. As of July 2020, Wells Fargo was one of the largest banks in the world with regards to market capitalization, followed by the Agricultural Bank of China.